Far From The Crowd

#208 Year 5 Week 19

Dear Friends,

Lots of money, healthy consumers, and thriving corporate America all speak to the unprecedented health of our economy. A flourishing economy provides the bedrock for solid stock market growth. But be warned: stocks are expensive (as I write: another record S&P 500 close) because economic conditions reflect near all-time beneficial extremes that won’t last forever. We don’t have to know when or how conditions will change to disrupt these cycles; we only need the experience to remind us that all good things come to an end.

Few would argue that stock valuations are high. Stocks are expensive because, in part, four key economic indicators that drive markets remain near historical extremes. When any or all of these critical drivers return to normal (and they will), stock prices will surely follow. Your portfolio allocation to risk, particularly stocks, should reflect this likely shift. While others are caught up in the frenzy of outsized market returns, ensure your stock allocation is reasonable before it’s too late.

I have heard many arguments rationalizing today’s stretched stock valuations, but it’s a fact that stocks are expensive. Using the price-to-earnings ratio (P/E) as a broad measure of stock valuation, today’s P/E sits above 28 (twelve-month trailing earnings). Compare that to a historical norm 19, and you see what I mean. (That’s almost one Standard Deviation variance for the statistics geeks reading this). One can argue valuations will remain elevated (it’s different this time!), but it’s hard to deny that, for now, stocks are expensive.

Four economic data points have propped up elevated stock prices.

The supply of money is near historical highs. I have written often about how the government has issued debt to finance the expansion of our money supply. Using the Fed’s reading of M2 as a proxy for money supply, a steady increase after the financial crisis led to a dramatic spike in 2022, only to nominally recede in the past two years. When more money chases the same (or fewer) goods, that leads to an increase in prices or inflation. It’s not just apples, restaurant prices, and the cost of services that spike; asset values like stocks are also juiced. When people have more money, they’re willing to spend more money, not always wisely. Compounding the problem, buyers are often drawn to rising prices when investing. They’re willing to pay more to own an overpriced stock to get in before prices rise even further. There is a fear of missing out on the next wave of returns. This leads investors to forgo objective stock analysis to jump on the momentum bandwagon. Momentum investing detached from objective analysis rarely ends well.

The unemployment rate is near historic lows, and household net worth is near landmark highs; both are signs of broad economic strength. The unemployment rate was 4.1% in June, having risen slightly from the pre-Covid low of 3.5%, a level we haven’t seen since the 70’s. Household net worth achieved a historical best in the weeks leading up to COVID-19, and like the unemployment rate, it has only moderated nominally since then. Both indicators speak to the unprecedented health of the consumer. When people are working, they spend money. When people's homes or stock portfolios grow, they feel more secure and spend more, a phenomenon known as the wealth effect. Consumer spending drives two-thirds of our economy, and the consumer has arguably never been in a better place. That won’t last forever.

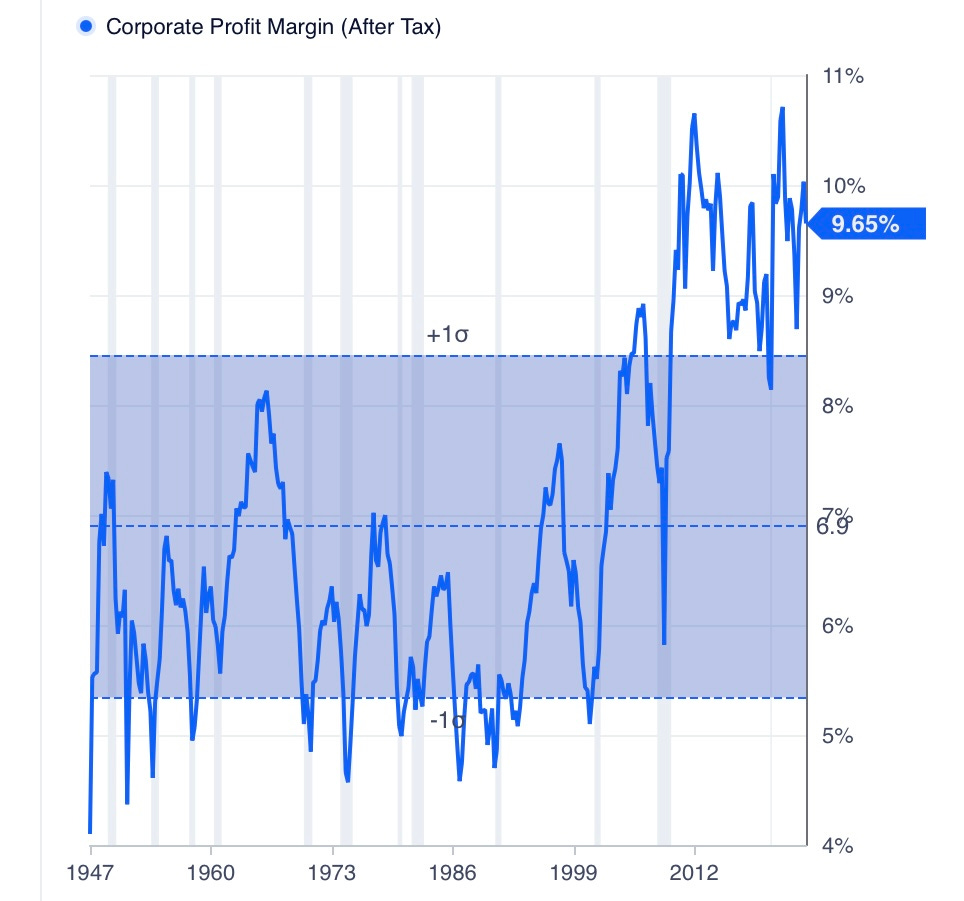

Corporate margins are near historical highs. See the chart below to understand how substantial corporate profits have been in the last ten years (more than one standard deviation!). In the most simplistic terms, stock prices are driven by interest rates and earnings. Strong earnings support rising stock prices. Strong companies provide a healthy economy and financially healthy employees. I’ve heard arguments that suggest today's 9.65% corporate profit margins are sustainable even as the historical average is 6.9%. I don’t believe it. Competition and greed are powerful forces. When companies make skewed profits, someone will find a way to grab a slice of that pie, and profits will return to normal.

From Gurufocus.com

Economics is the study of cycles, and experience teaches us that most extreme conditions regress to the mean or return to normal. Forget about the headlines, recent momentum, and FOMO; let the fundamentals guide your investment decisions, and you’ll benefit in the long run. When you disconnect from the data, you risk buying high and selling low (or vice-versa), which is the cardinal sin of investing. Stock valuations are elevated. Economic conditions are at extremes. Now is a time for caution. Stay the course if you’ve adhered to a plan that has embraced below-normal risk (like me). If your stock allocation has become overly aggressive, now is a great time to sell and bank appropriate gains. You might be out of step with the crowd for a while, but you’ll be miles ahead in the long run. It’s not where you start but where you finish that matters.

Stay in touch,

brian

What do you think boss, Yardeni says 8000 s&p500 by 2030? Maybe trees do grow to the sky.

Crowds are usually wrong: maddening...